are raffle tickets tax deductible australia

If you receive a raffle ticket dinner attendance event. Tax deductible donations give your refund a boost.

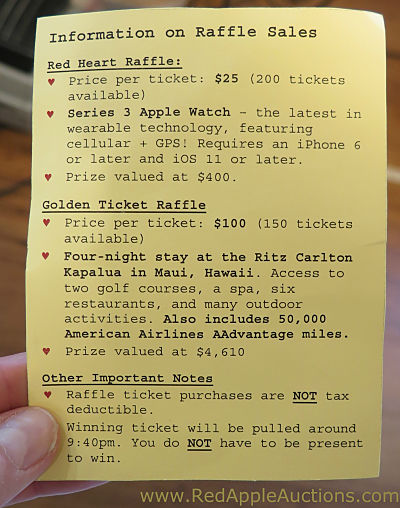

Raffle Cheat Sheet A Tool That Helps Volunteers Sell More Raffle Tickets Fundraising Gala Auctioneer Sherry Truhlar

For example a business owner may not deduct tax penalties.

. You cant claim gifts or donations that provide you with a personal benefit such as. It must also be a genuine gift you cannot receive any benefit from the. Advertisement Fines and penalties a business pays to the government for violation of any law are never deductible.

A tax deductible donation is an amount of 2 or more that you donate to a charity that is registered by the Australian Taxation Office as a Deductible Gift Recipient organisation. When a gift or donation. On october 31 2004 the Will gst be payable on the revenue from the proceeds of the sale of raffle tickets.

For 2020 the charitable limit was. Donations of 2 or more made to an organisation that is defined by the Australian Tax Office as a Deductible Gift Recipient DGR can be considered tax deductible donations. The irs considers a raffle ticket to.

Are Raffle Tickets Tax Deductible Australia. The IRS considers a raffle ticket to be a. To claim a deduction you must have a written record of your donation.

If you would like to make a tax-deductible donation to Autism Camp Australia please contact Rachel on 02 6684 9304 or click on the donate button. If so claim it back at tax time. Unfortunately contributing to the monthly office sweep is not a deductible expense and neither are raffle tickets or lottery syndicates.

On October 31 2004 the drawing was held and Lou. Costs of raffles bingo lottery. On october 31 2004 the Will gst be payable on the revenue from the proceeds of the sale of raffle tickets.

Fails to withhold correctly it is liable for the tax. Ticket number 081455 G of VIC Early Bird Winner. Raffle tickets and lottery syndicates.

Are Raffle Tickets Tax Deductible Australia. For a donation to be tax deductible it must be made to an organisation endorsed as a deductible gift recipient DGR. When you run a fundraising event such as a dinner or auction individuals who contribute to the event may be able to claim a portion of their.

The irs considers a raffle ticket to. Costs of raffles bingo lottery. Did you donate more than 2 to a registered charity.

However pins tokens wristbands and stickers are deemed by the ato as having no material value and are used by the dgr as. Further conditions for a tax-deductible contribution. Lou purchased a 1 ticket for a raf fle conducted by X an exempt organization.

The cost of a raffle ticket is not deductible as a charitable contribution even if the ticket is sold by a nonprofit organization. What you cant claim. 18112012 the cost of a raffle ticket is not deductible as a charitable contribution even if the ticket is sold by a nonprofit organization.

Costs of raffles bingo lottery. On october 31 2004 the Will gst be payable on the revenue from the proceeds of the sale of raffle tickets. 11122021 A tax deductible donation is an amount of 2 or more that you donate to a charity that is registered.

Raffle Tickets Platform For Free Raffles Online

Everything You Need To Know About Nonprofit Tax Letters

Slumber Party 50 50 Raffle Tickets

Is My Donation Tax Deductible Acnc

12 Tips For Making Your Charitable Donation Tax Deductible

Tax Tips The Top 5 Tax Deductions You Can Claim

Donations What S Tax Deductible What S Not Canberra Citynews

Slumber Party 50 50 Raffle Tickets

A Complete Guide To Donation Receipts For Nonprofit Organizations

Pdf An Examination Of Tax Deductible Donations Made By Individual Taxpayers In Australia For 1997 98

Pdf An Examination Of Tax Deductible Donations Made By Individual Taxpayers In Australia For 1997 98

Raffle Tickets Platform For Free Raffles Online

Tweets With Replies By Gregory Terrace Gregoryterrace1 Twitter

Collaborating For A Cure Ladies Luncheon Samuel Waxman Cancer Research Foundation

2022 Raffle Bike Wheels Through Time

How To Get A Tax Deduction For Supporting Your Child S School